Reinventing the Financial Services Value Chain

Delta Capita, the Financial Services Platform of Prytek, is a leading global Capital Markets consulting, managed services, and technology provider with a unique combination of experience in financial services and capability in technology innovation.

65+

Clients Globally

1,000+

Expert practitioners and consultants globally

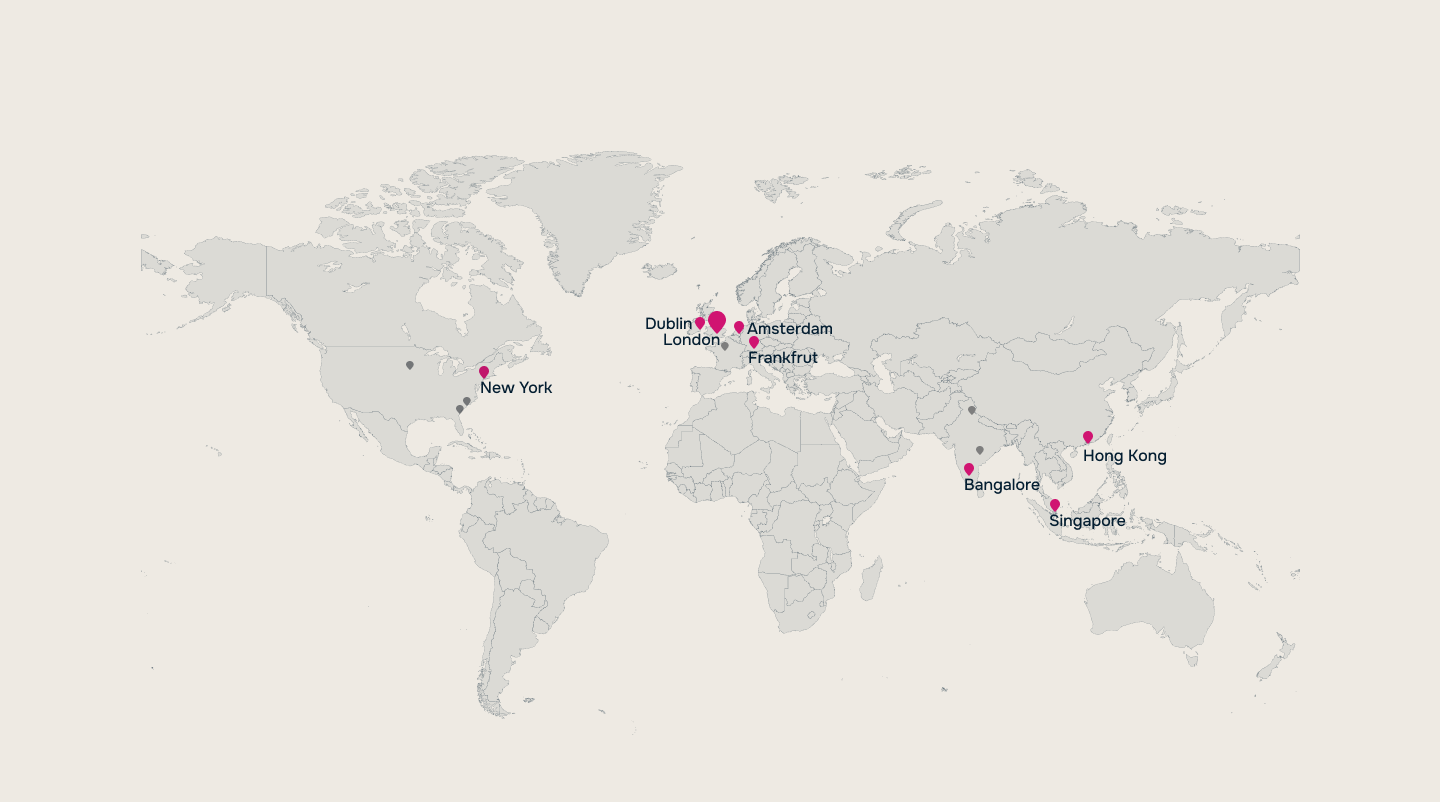

Global Client Base

Covering Capital Markets, Wholesale Banking, Retail, Wealth and Insurance

Our Business Services:

Client Lifecycle Management

Post Trade Services

Payments

Structured Retail Products

Trading, Pricing and Risk

Enterprise Technology

Our Global Distribution Capability:

Our Production Environment Support:

Our Corporate Infrastructure:

PROPRIETARY TECHNOLOGY PRODUCTS

1

An industry-leading technology, coupled with deep understanding of the Capital Markets landscape, that allows the design of transformational solutions, whilst helping to solve existing business and cost challenges. MACH product suite: Optimise, Tokenise, Ledger, Assign, Pass, and Bridge, to realise the substantial benefits of bespoke solutions.

2

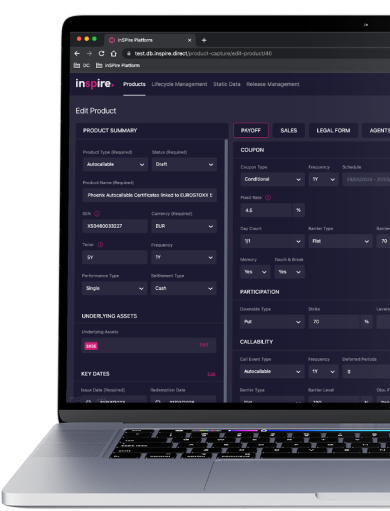

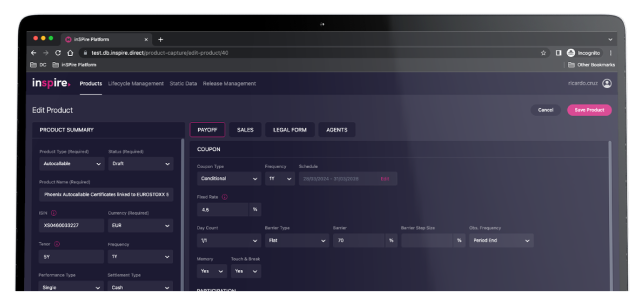

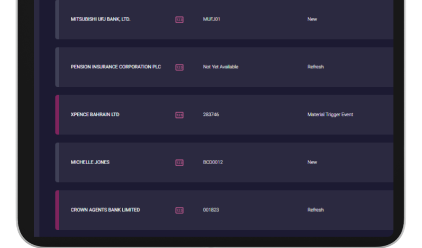

Structured Products Issuance and Post-Trade Lifecycle inSPire platform provides multiple service access options. Data ingestion and validation is controlled by business configurable rulesets while data can be translated to provider specific formats. Users benefit from a single consistent environment, consolidated MI, and access to superior control tooling.

3

Karbon platform is a state-of-the-art tool providing identity management across business units and service channels, both at scale and in real time. The Platform automates, provides visibility and streamlines clients, time-consuming processes and reduces cost.

4

Helps to improve client experience by reducing enquiry response and resolution times. Leverage data driven insights about team communication to improve productivity and reduce risk.

5

SOCaaS

24×7 Security Operations Centre as a Service, allows clients to leverage the world-class expertise of cyber professionals, at a fraction of the cost of building and maintaining a SOC themselves.

Joe Channer

CEO, Delta Capita

Joe Channer specialises in recognising and investing in strategic opportunities to grow the Delta Capita ecosystem and better service organisations looking to improve their business operations. Along with strong commercial, product, technical and regulatory expertise, Joe translates business strategy into target operating models, business cases, and roadmaps.

David Long

Chief of Staff, Delta Capita

David has had an extensive and broad career spanning more than 30 years in tier one investment banking. He has held several senior positions including Group COO for EMEA, COO Fixed Income, Executive Board membership and legal entity directorships of both Credit Suisse and industry-wide entities including the British Bankers Association and the world’s largest FX broker, EBS Ltd.

David specialises in the study of Conduct and Behaviour and leads Conduct training for the Banking Industry.

He is a member of the Institute of Operational Risk and has an MBA from Cass Business School, London.

Phillip FreeBorn

Global Head of Services, Delta Capita

Philip has lived and worked in the UK, US and South Africa, managing global and regional diverse teams. Philip was previously the Head of IT and Operations for Barclays Investment Bank, the COO for Barclays Wealth and the Head of Integration and COO for Barclays Africa. He also was the CIO for UBS Investment Bank.

Prior to his career in Banking, Philip qualified as a Chartered Account and holds a degree in engineering BSc and is an AKC. Philip continues to mentor people both inside and outside the firm. Philip’s deep experience in banking allows him to advise on technology and operational strategy at board level. He also has strong experience in managing outsourcing of certain functions, re-insourcing and creating mutualised managed services.

Mark Aldous

Chief Operating Officer, Delta Capita

Mark is a specialist in managing operationally complex capital markets businesses through development, growth, restructuring and integration. Mark has extensive experience as a business owner and business manager across Structured Products, Derivatives and Alternative Investments at leading global investment banks in London, New York, Zurich and Hong Kong.

At Delta Capita, Mark is Group Chief Operating Officer and responsible for oversight of the groups long term business strategy, technology delivery, Sales and Marketing functions. Mark also founded Delta Capita’s Structured Products business which provides services and technology to a number of major global structured product issuers.

Mark studied marketing at the Chartered Institute of Marketing and holds a number of Securities industry certifications.

Dominic Amura

Head of Post-Trade and Market Infrastructure, Delta Capita

Dom has over 30 years’ experience in Investment Banking Operations and Middle Office, leading teams in some of the largest tier one investment banks globally.

Prior to working with Delta Capita, Dom was the Global Head of Equities Middle Office and Operations at HSBC leading of over 600 staff across 7 global locations. Additionally, he held various senior Derivative and Prime Finance operations roles at Credit Suisse including being the European Head of Derivative Operations.

Karan Kapoor

Global Head of Regulatory and Risk Consulting, Delta Capita

Karan Kapoor is a Capital Markets and Banking Change Professional with domain experience in Fixed Income, Equities, Securities Services, Wealth Management, AML alongside expertise in Regulatory and Business Change and Transformation.

James Baker

Head of Structured Product Platform, Delta Capita

James has over 20 years of experience within Investment Banking and Capital Markets, specialising in the Wealth Management and Retail client segments. James joined Delta Capita from Barclays where he worked within Structuring, holding the position of Global Head of Platform and Issuance Development where he was responsible for their global market leading structured products technology and issuance capabilities. During his five years at Barclays James oversaw many critical developments including PRIIPs KIDs, documentation automation, platform and service connectivity projects which are all central to Delta Capita’s service offering. Prior to joining Barclays James spent 18 years at Credit Suisse.

James holds a First-Class Honours degree in Mathematics from the University of St. Andrews. He is a Fellow of the Institute of Chartered Accountants in England and Wales, having trained at Deloitte prior to joining Credit Suisse

Michael Levens

Head of Payments, Delta Capita

Prior to joining Delta Capita, Michael worked as Digital Payments Product Head at HSBC. He created and led new digital payment products initiatives, including the delivery and global commercialisation of HSBCnet Track Payments & SWIFT gpi and ISO 20022 adoption. Michael’s experience also includes launching innovative entrepreneurial ventures complimented by a diverse educational background in Information Technology and postgraduate business qualifications from London Business School and University of Cambridge.